Banking Reset

A Storm Is Coming

Many banksters never stopped doing the same reckless things that caused the last crash in 2008. A massive storm is now brewing over the entire industry. But this time, we won't be able to bail our way out of it. For several reasons, including a regional banking implosion, a commercial real estate bubble, international de-dollarization, and $100 trillion dollar black swan event set to go off this year, the entire western-led global financial system is about to collapse. Nothing that our policymakers normally do to prevent crashes will work this time. We must prepare for the most severe financial turbulence in our nation's history, and move quickly to execute unorthodox maneuvers that will enable us to adapt and survive.

Brace For Impact

Severe Economic Turbulence Ahead

Countdown To Calamity

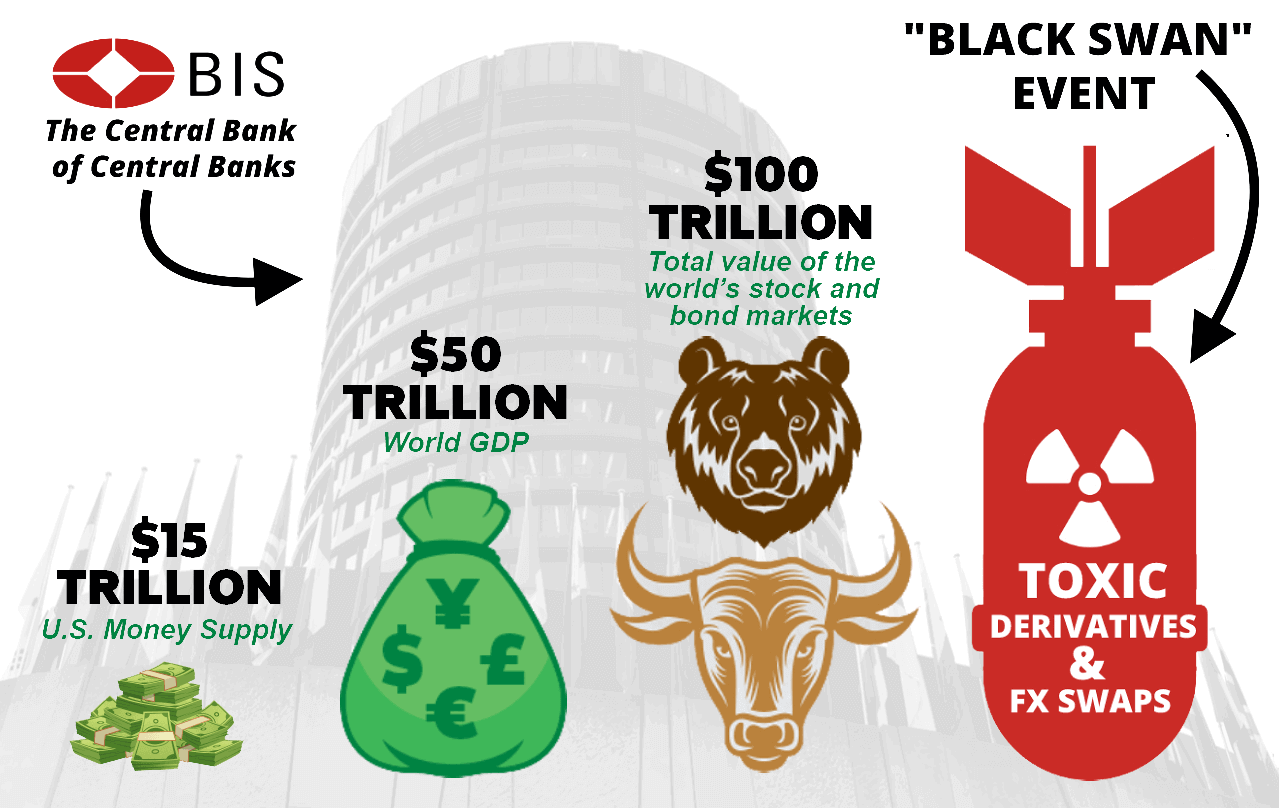

The Bank for International Settlements (BIS) has warned that the global financial system is on the brink of a $100 trillion dollar "black swan" event - a perfect storm large enough to wipe out the entire world economy. This (highly volatile) financial weapon-of-mass-destruction could be triggered by a wide range of factors, including a sharp rise in interest rates, a decline in asset prices, or a sudden loss of confidence in the financial system. All of which are in the process of happening now.

Global De-Dollarization

As the US continues it's out-of-control spending, and continues alienating the rest of the world with shameless imperialism in Ukraine, (causing them to abandon the dollar en-mass), the Fed will be forced to keep raising interest rates sharply to combat intensifying inflation. But it won't work - it'll only push our economy deeper into the storm.

Banking Collapse

The Fed's dramatic recent interest rate increases have, and will continue to cause a number of banks to collapse. In March 2023, Silicon Valley Bank and Signature Bank failed, becoming the largest bank failures in recent history. Many other banks are now teetering on the brink, and the entire system will likely collapse very soon.

Commercial Real Estate Bubble

Real Estate prices rose rapidly in recent years, fueled by easy credit and speculative investment. However, between the sharp interest rate increases, and the dramatic decrease in demand caused by the pandemic, our commercial real estate market has ballooned into a massive bubble that is about to burst and collapse.

"Derivatives are financial weapons of mass destruction."

Nothing Can Stop What Is Coming

Accept The Economic Enema

Abolish The Fed

The Federal Reserve is a destructive and corrupt cartel controlled by malign super-national influences. Its ability to print unlimited money has debased the value of our dollar, leading to inflation and making our hard-earned money worth less and less every day. Meanwhile, politicians have used this unlimited money to fund endless wars and bailouts for big corporations, leaving the American people to foot the bill. The Fed was created to prevent financial collapses, but it has not prevented a single one. Instead, it has presided over some of the worst financial crises in our nation's history, and is currently mismanaging us into the most catastrophic one yet. We must abolish the Federal Reserve and decentralize money.

Modernize The Money System

Crackdown On Offshore Banking

City of London, the world's leading offshore banking hub, has long been a haven for money laundering and tax evasion. To combat this problem, the US government must pressure the UK to formally annex the City of London and force it to comply with UK banking regulations (i.e. KYC requirements). This simple move would effectively "pull-the-chair" out from under a huge portion of the world's offshore banking industry, driving massive amounts of offshore capital out of sketchy banks and into the crypto markets. Dramatically reducing volatility and stabilizing Non-Government Digital Currency (NGDC) markets enough for practical everyday use. The City of London is a corrupt medieval loophole which enables oligarchs and intel agencies to fleece the taxpayers of all nations - and it must be agressively closed.